Examples

🟩 Example 1: Long Call (Bullish Bet)

✅ Setup

- BTC Spot Price: $85,381.9

- Strategy: Alice is bullish and buys a Call Option — BTC-USD-88000-C

- Strike Price: $88,000

- Ask Price: $248.9

- Mark Price: $192.9

🧮 Order Entry

- Alice can choose to enter the order size in either BTC or USD Spot Notional (Size x Spot Price) terms.

- Alice enters a $2,000 USD Notional →

0.023 BTCor (2,000 / 85,381) - She submits a market buy at $248.9

- Position Opened:

- Size: 0.023 BTC

- Entry Price: $248.9

- Spot Notional = Size x Spot Price=

0.023 × 85,381≈ $1,963 - 8h Funding Rate: 0.0749% → Expected funding cost per 8h =

0.023 × 0.000749 × 85,381≈ $1.47 - Unrealized PnL at Entry =

0.023 × (192.9 - 248.9)≈ 1.30 USD- Alice has a slight Unrealized PnL at Entry because the Mark Price ($192.9) is below the Entry Price ($248.9)

After 12 Hours

- Spot Price rises from $85,381 to $87,000

- Mark Price rises from $192.9 to $503

- Avg 8h Funding Rate (over 12 hours): 0.08%

- Avg Spot Price (over 12 hours): $86,000

- Funding Cost ≈

0.023 × 0.0008 × 12 ÷ 8 × 86,000≈ $2.37

Final PnL

- Option PnL:

0.023 × (503 - 248.9)≈ +5.84 USD - Less Funding: 2.37 USD

- Total Unrealized PnL: +3.47 USD

- PnL %:

3.47 ÷ (0.023 × 248.9)≈ +61%

🟥 Example 2: Long Put (Bearish Bet)

✅ Setup

- BTC Spot Price: $85,381.9

- Strategy: Bob is bearish and buys a Put Option — BTC-USD-83000-P

- Strike Price: $83,000

- Ask Price: $233.2

- Mark Price: $199.8

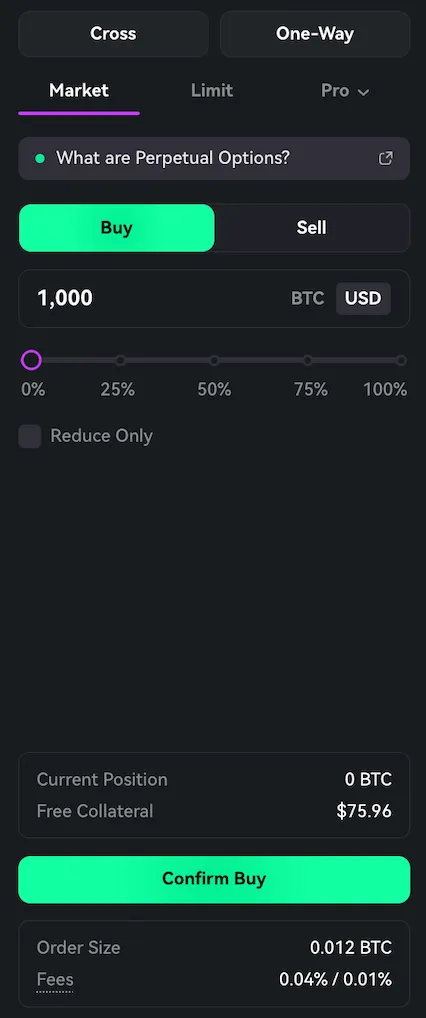

🧮 Order Entry

- Bob can choose to enter the order size in either BTC or USD Spot Notional (Size x Spot Price) terms.

- Bob enters a $1,000 USD Spot Notional →

0.012 BTC - Submits a market buy at $233.2

- Position Opened:

- Size: 0.012 BTC

- Entry Price: $233.2

- Spot Notional = Size x Spot Price =

0.012 × 85,381≈ $1,024.57 - 8h Funding Rate: 0.078% → Expected funding cost per 8h =

0.012 × 0.00078 × 85,381≈ $0.80 - Unrealized PnL at Entry =

0.012 × (200.1 - 233.2)≈ $0.39- Bob has a slight Unrealized PnL at Entry because the Mark Price ($200.1) is below the Entry Price ($233.2)

After 12 Hours

- Spot Price drops from $85,381 to $83,500

- Mark Price rises from $200.1 to $605

- Avg 8h Funding Rate (over 12 hours): 0.10%

- Avg Spot Price (over 12 hours): $85,000

- Funding Cost ≈

0.012 × 0.0010 × 12 ÷ 8 × 85,000≈ $1.53

Final PnL

- Option PnL:

0.012 × (605 - 233.2)≈ +4.46 USD - Less Funding: 1.53 USD

- Total Unrealized PnL: +2.93 USD

- PnL %:

2.93 ÷ (0.012 × 233.2)≈ +105%

🟥 Example 3: Short Call (Bearish Bet - Expecting Low Volatility)

✅ Setup

- BTC Spot Price: $84,332.3

- Strategy: Charlie is bearish and expects low volatility. He sells a Call Option — BTC-USD-84000-C

- Strike Price: $84,000

- Bid Price: $1,112.5

- Mark Price: $1,140.6

- 8h Funding Rate: 0.3195%

🧮 Order Entry

-

Charlie can choose to enter the order size in either BTC or USD Spot Notional (Size x Spot Price) terms.

-

Charlie enters a $1,500 USD Spot Notional →

0.018 BTC -

Submits a market sell at $1,112.5

-

Position Opened:

- Size: 0.018 BTC

- Entry Price: $1,112.5

- Spot Notional = Size x Spot Price =

0.018 × 84,332.3≈ $1,518 - 8h Funding Rate: 0.3195% → Expected funding cost per 8h =

0.018 × 0.003195 × 84,332.3≈ $4.85 - Unrealized PnL at Entry =

-0.018 × (1,140.7 - 1,112.5)≈ 0.50 USD- Charlie has a slight Unrealized PnL at Entry because the Mark Price ($1,140.7) is above the Entry Price ($1,112.5)

After 12 Hours

- Spot Price drops from $84,332.3 to $84,000

- Mark Price drops from $1,140.7 to $961

- Avg 8h Funding Rate (over 12 hours): 0.35%

- Avg Spot Price (over 12 hours): 84,200

- Funding Profit:

0.018 × 0.0035 × 12 ÷ 8 × 84,200≈ 7.95 USD

Final PnL

- Option PnL:

-0.018 × (961 - 1,112.5)≈ +2.73 USD - Plus Funding: 7.95 USD

- Total Unrealized PnL: +10.68 USD

- PnL %:

10.68 ÷ (0.018 × 1,112.5)≈ +53%

🟩 Example 4: Short Put (Bullish Bet - Expecting Low Volatility)

✅ Setup

- BTC Spot Price: $84,410.1

- Strategy: Dave is bullish but expects low volatility. He sells a Put Option — BTC-USD-84000-P

- Strike Price: $84,000

- Bid Price: $701.0

- Mark Price: $709.2

- 8h Funding Rate: 0.2801%

🧮 Order Entry

-

Dave can choose to enter the order size in either BTC or USD Spot Notional (Size x Spot Price) terms.

-

Dave enters a $2,000 USD Spot Notional →

0.024 BTC -

Submits a market sell at $723.0

-

Position Opened:

- Size: 0.024 BTC

- Entry Price: $723.0

- Spot Notional = Size x Spot Price =

0.024 × 84,410.1≈ $2,024 - 8h Funding Rate: 0.2801% → Expected funding cost per 8h =

0.024 × 0.002801 × 84,410.1≈ $5.67 - Unrealized PnL at Entry =

-0.024 × (730.4 - 723.0)≈ 0.17 USD- Dave has a slight Unrealized PnL at Entry because the Mark Price ($730.4) is above the Entry Price ($723.0)

After 12 Hours

- Spot Price rises from $84,410.1 to $84,500

- Mark Price drops from $730.4 to $675

- Avg 8h Funding Rate (over 12 hours): 0.27%

- Avg Spot Price (over 12 hours): 84,450

- Funding Profit:

0.024 × 0.0027 × 12 ÷ 8 × 84,450≈ 8.20 USD

Final PnL

- Option PnL:

-0.024 × (675 - 723.0)≈ +1.15 USD - Plus Funding: 8.20 USD

- Total Unrealized PnL: +9.36 USD

- PnL %:

9.36 ÷ (0.024 × 723.0)≈ +54%