Introduction to Perpetual Options

What are Perpetual Options?

Perpetual Options are a novel new crypto derivative instrument that combines the risk-reward profile of options (protected downside with unlimited upside) with the simplicity of perpetual futures.

Perpetual options are:

Unlike traditional options that have a fixed expiration date, Perpetual Options can be held indefinitely, reducing expiry timing risk

Instead of paying a large premium upfront, traders pay (or receive) a continuous funding rate based on market conditions to hold a position

They follow the same straightforward PnL structure as perpetual futures (entry price, exit price, funding)

Core Idea

Perpetual Options fit naturally within the derivative framework crypto traders know and love (perpetuals) while offering a new way to access leverage without taking price-based liquidation risk.

Why Trade Perpetual Options?

Perpetual options blend the upside of leverage with built‑in downside protection—so you can stay in a trade, without the constant threat of getting liquidated (by price).

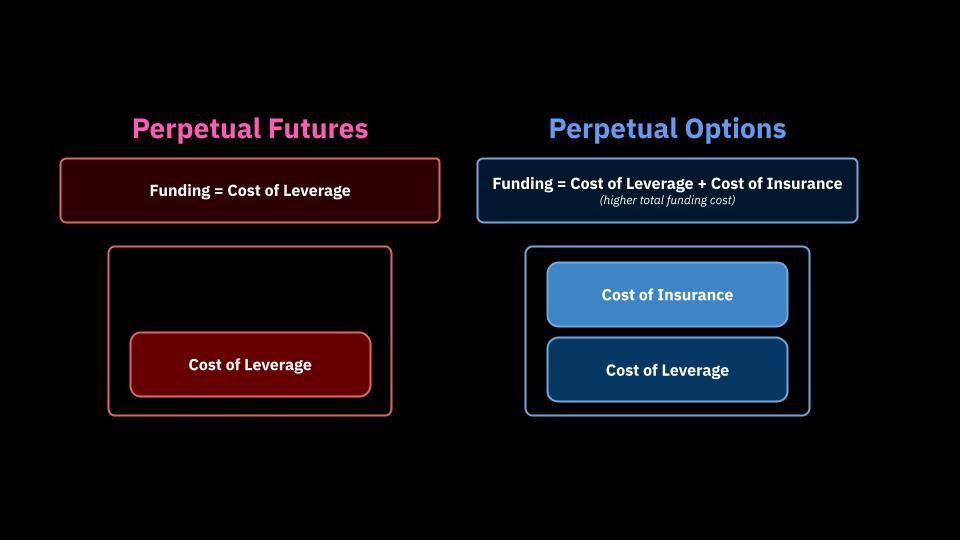

In perp options, the extra funding also covers downside protection, so price swings are less deadly. In perp futures, funding simply pays for leverage.

Detailed Comparisons

vs Perpetual Futures

vs Dated Options

Core Idea

In simple terms, Perpetual Options can be thought of as “insurance-enhanced” perpetual futures, where you pay a higher funding rate in exchange for protection against adverse price movements.

Margin and Risk Comparison

A key advantage of Perpetual Options is their unique margin structure compared to perpetual futures:

Unlike futures, option buyers cannot be liquidated due to adverse price movements

Especially with out-of-the-money options, achieve effective leverage >50x

Your maximum risk is limited to the funding you pay while holding the position