Quote Quality Score

Quote Quality measures how valuable a liquidity provider’s (LP) orders are to the market. It rewards LPs who place orders close to the current market price and provide liquidity on both bid and ask sides.

XP Distribution (225,000 / week)

For the purposes of weekly XP distribution, we sum quote quality by user by market over the week and divide by total number of samples (~ every 1 minute). This gives us a single average quote quality metric we use for determining a users share of total exchange quote quality.

Note: Quote Quality XP is as subset of the base 4,000,000 weekly XP distribution.

XP Distribution

- 75,000 (33%) - Tier 1 Perps

- 150,000 (67%) - Tier 2 Perps

The Process

- Sample Collection: Quote Quality samples collected throughout the week

- Weekly Average: Sum all samples ÷ number of samples = your average Quote Quality

- Market Share: Your average ÷ total of all users’ averages = your share %

- XP Distribution: Your share % × weekly XP pool = your XP earned

Key Points

- Consistency matters: Need to provide liquidity throughout the week, not just peak times

- Quality beats quantity: Tight spreads earn more than large but wide orders

- Tier separation: Each instrument tier has its own XP pool

- Relative competition: Your rewards depend on your performance vs. other LPs

Key Concepts

Quote Quality Calculation

Measure Order Distance from Market

For each order, we calculate how far its price is from the current reference price:

Where:

- TOB = Top-of-book price (best bid for bids, best ask for asks)

- mid = Mid-market price (average of best bid and best ask)

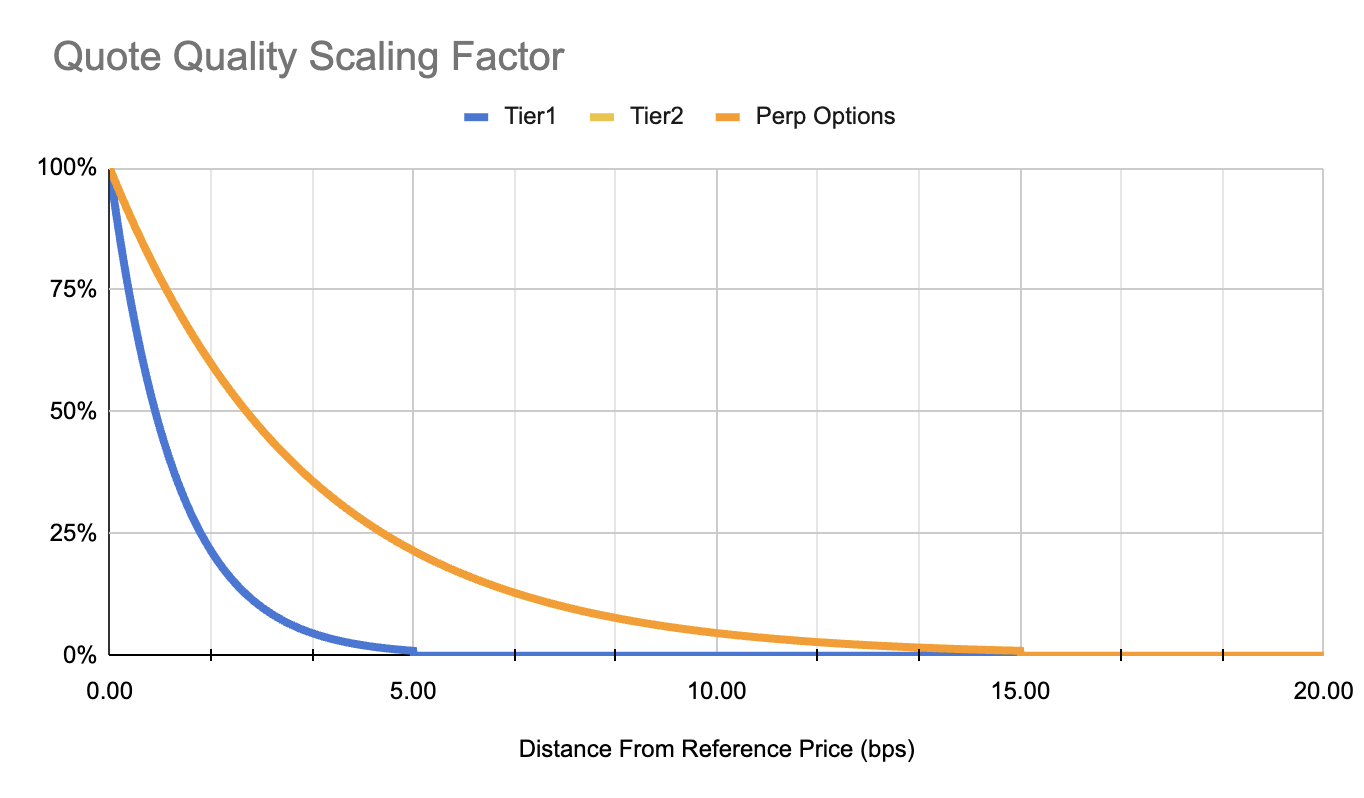

Apply Distance Penalty

Orders farther from the reference price receive exponentially less weight. Each order’s adjusted value is calculated as:

The scaling factors are instrument-specific and designed so orders at maximum spread receive only 1% weight. Orders beyond the Max Spread are completely excluded from calculations.