Volume on Mark Price Chart

Volume data is now available on both mark price and last price charts. You can now switch between mark price and last price views while maintaining full volume visibility for comprehensive chart analysis.

Thanks to @c45p4r for suggesting this improvement.

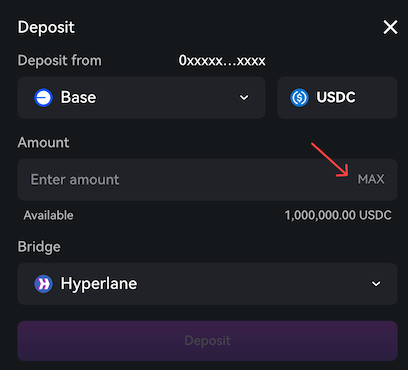

Deposit Max USDC

Click “Max” to auto-fill your entire USDC balance instead of typing amounts, reducing the time it takes to get back to trading. USDC balances for accounts on all chains are now visible in the deposit modal. This was previously limited to the Ethereum network.

Thanks to @manifestryker for suggesting this improvement.

Bid/Ask/Mid buttons for closing limit order modal

Added Bid, Ask, and Mid buttons to the close limit order modal. Click any button to auto-fill the price field with current market data.

Thanks to @imridam for suggesting this improvement.

Bug fixes & improvements

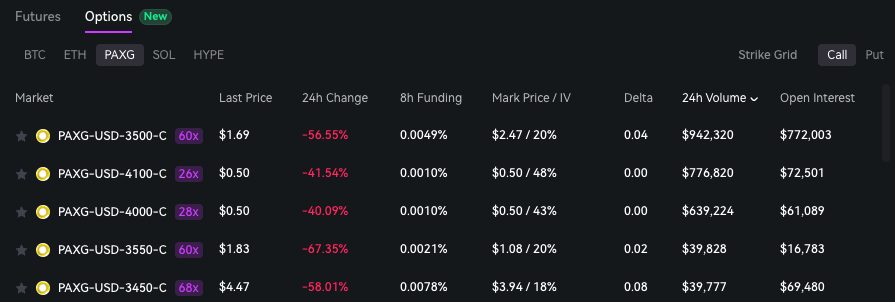

- Searchable market alias (Gold for PAXG Options)

- Fixed order size slider calculations

- RPI savings calculation now adjusts for aggregated RPI pricees

Portfolio Margin (Invite Only Beta)

We’ve launched Portfolio Margin in invite-only beta, a sophisticated risk management system that evaluates your entire portfolio holistically rather than each position independently. By recognizing correlations and hedged positions, it typically reduces margin requirements while providing a more accurate reflection of your portfolio’s true risk profile. This feature is ideal for active traders, options strategists, and sophisticated users seeking improved capital efficiency.

PAXG Perp Options

We’ve added PAXG (Pax Gold) perpetual options to our platform, expanding beyond our existing BTC, ETH, SOL, and HYPE markets. As our first lower volatility perpetual options market, PAXG opens up new strategic opportunities for traders looking to explore options strategies in a more stable underlying asset tied to gold prices. This addition provides diversification for options traders seeking exposure beyond high-volatility crypto assets.

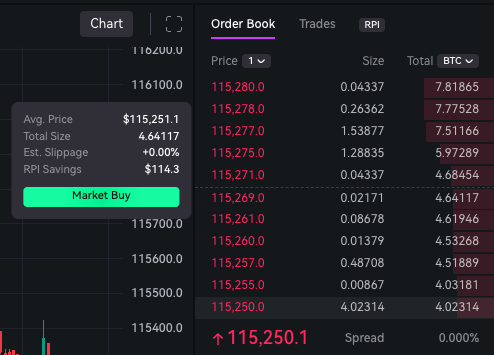

RPI Savings on Orderbook

We’ve added a Retail Price Improvement (RPI) savings popup to the orderbook that displays estimated slippage and RPI savings when you hover over orders, allowing you to quantify the price improvement you receive when trading on Paradex.

Bug fixes & improvements

- Mobile Markets Menu now includes sortable Open Interest, 24h Volume, and Funding Rate data for easier market assessment

- TWAP orders now have access to RPI liquidity (@stochasticfranklin)

- Fixed bug where TPSL market order fails when set too close to liquidation price

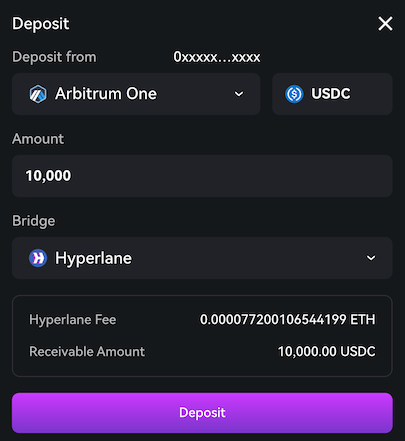

Interchain Deposits powered by Hyperlane (Beta)

USDC deposits are now supported from Solana, Ethereum, Arbitrum, Base, and Starknet through Hyperlane’s permissionless interoperability protocol. This initial release focuses on deposits with a $250,000 liquidity cap during the testing phase. Withdrawal support and additional networks will be added following successful testing, with Paradex Vault tokens also being upgraded for full multi-chain compatibility in the coming weeks.

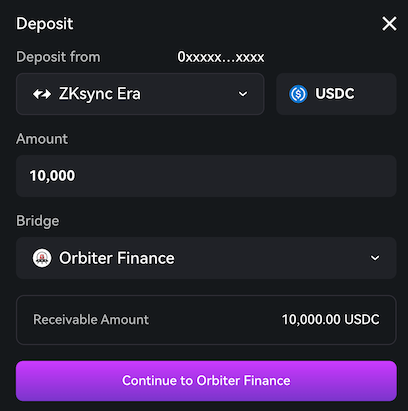

Bridge using Orbiter Finance

Added Orbiter Bridge support for deposits and withdrawals across 17 blockchain networks. This provides an additional bridging option alongside existing methods (Paradex Bridge, Layerswap, RhinoFi, and Hyperlane) for transferring funds to and from the platform.

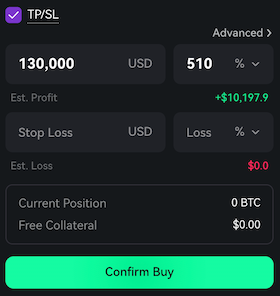

Estimated P&L in TP/SL order builder

Estimated profit/loss amounts in dollars now display directly within the Take Profit/Stop Loss section of the order builder’s basic view. This information was previously available elsewhere but is now shown inline to reduce navigation and provide immediate P&L visibility when setting TP/SL levels.

Thanks to @c45p4r for suggesting this improvement.

Bug fixes & improvements

- View positions from Trade Summary page without navigating to separate screen (mobile)

- Apply default max slippage per market when user hasn’t configured custom slippage settings

Calculate Size in TPSL

You can now specify your desired risk amount in dollars when setting TPSL orders, and the system will automatically calculate the appropriate position size. This eliminates the need to manually calculate position sizing or use external tools to determine how much you’ll risk on each trade.

Thanks to @warren_muppets for suggesting this improvement.

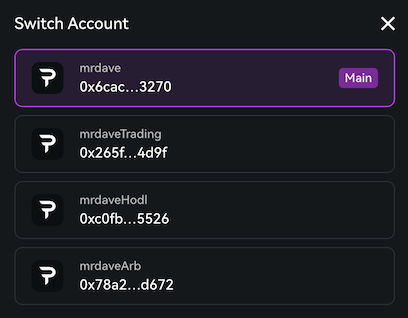

Display usernames in Switch Account modal

Account usernames now display in the Switch Account modal (alongside wallet addresses) and main account menu (top-right corner). This makes it easier to identify and switch between different accounts and sub-accounts without relying solely on wallet addresses for identification.

Thanks to @therealzerve for suggesting this improvement.

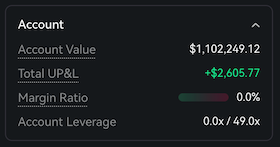

Portfolio and Account Summary now show Total UP&L

Portfolio and Account Summary previously displayed only account balance and unrealized trading P&L, excluding unrealized funding which is critical for portfolio assessment and order planning. These sections now show Total Unrealized P&L, combining both unrealized trading P&L and unrealized funding for complete portfolio visibility.

Thanks to @addr1kajjuw8l6p3ndl for suggesting this improvement.

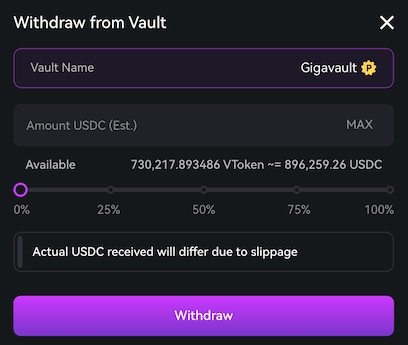

Withdraw vault tokens in USDC terms

Vault withdrawals now allow you to specify the target amount in USDC rather than vault tokens (vTokens). This eliminates the need to manually calculate vToken amounts and makes withdrawals more intuitive, though the final USDC amount may vary slightly due to slippage.

Thanks to @vukt97 for suggesting this improvement.

Bug fixes & improvements

- Added chart resizing by dragging the bottom border up/down

- Aggregated RPI orders in order book UI

- Fixed External EWMA utilization in Mark Price calculation

Aggregate multiple fills on trade history

Track your trades more easily with our new fill aggregation feature. When a single order results in multiple partial fills, you can now view them as one consolidated entry instead of cluttered individual fills.

Toggle between detailed and consolidated views using the “Aggregate” option in your Trade History tab and TradingView chart.

Thanks to @vladkens for suggesting this improvement.

Resizable charts on trade page

Manage more positions without scrolling by resizing your charts. You can now drag the chart/order book section to reduce chart height and create more screen space for your position management. Simply drag the divider between sections to adjust the layout to your preference.

Thanks to @vladkens for suggesting this improvement.

Weekly and monthly chart timeframes

Perform technical analysis more efficiently with new 1W and 1M quick filters added to TradingView charts.

Thanks to @theLKstyles for suggesting this improvement.

Bug fixes & improvements

- Increased spread precision to 3 digits

- Added Greeks and Contract Detail tabs to mobile app

- Improved WalletConnect connection recovery after failed connection

- Fixed bug preventing Privy authenticated accounts from depositing